Our Operational Efficiency

India’s Aspiring Home Ownership

In recent years, India’s landscape of aspiring homeownership has experienced significant growth with a need for jhatpat home loans. Driven by favorable Government policies, easier access to housing finance, and the desire for stability and security, the demand for affordable housing in India has surged. This has led to the emergence of innovative financing options aimed at making homeownership more accessible to a broader segment of the population, seeking reliable and jhatpat solutions to fulfill their needs. Furthermore, the rise of technology and digital platforms have revolutionised the real estate industry, offering prospective homebuyers greater transparency, convenience, and access to information that enables them with more informed decisions.

Growing Population to Drive the Housing Market

India is home to a substantial share of the global population, and projections indicate that the country’s total population is likely to reach 1.5 Billion by 2023. This, in turn, is anticipated to generate a huge demand for the housing sector and other real estate-related services in the near term. Among the overall population, the millennial generation which represents approximately 34% of the total population, exhibits a significant inclination towards homeownership. In 2020, this demographic accounted for more than 50% of the homes sold, and they played a significant role in propelling the Indian real estate market, surpassing the 54% mark in 2022.

1.5 Bn

Total

population by 2023*

34%

of the

population

are the millennials**

54%

of total housing sales

were

made to the millennials

in 2022#

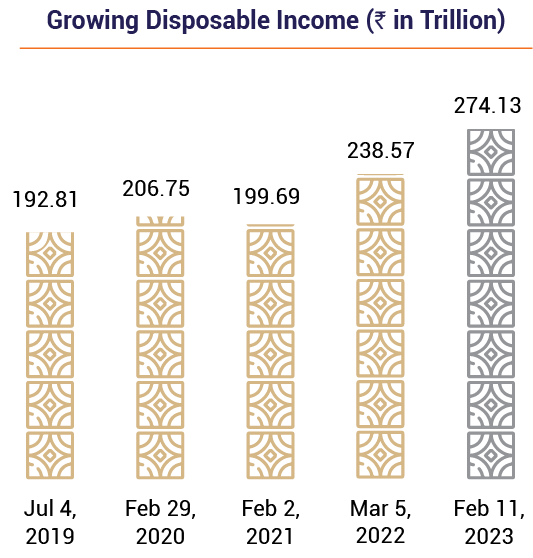

Growing Disposable Income

The nation has recently witnessed an upswing in the disposable incomes of its population, which is expected to have a catalytic impact on the housing market. In 2023, India’s disposable personal income reached a significant milestone of ₹ 274.13 Trillion (USD 3,328.893 Billion), marking a substantial increase since 2020.

Shift to Green Affordable Housing

Green affordable housing refers to housing units that are designed, constructed, and operated in an environmentally sustainable manner while remaining affordable for low- to moderate-income individuals and families. It combines the principles of affordability and environmental sustainability, and incorporates various features that reduce energy consumption, water usage, and several other impacts such as efficient sanitisation, energy-efficient design, and usage of sustainable materials.

The Government’s unwavering commitment to sustainability and its proactive role in promoting environmentally responsible practices have created a favorable environment for the growth of the Sustainable Housing sector. This positive momentum is set to continue as we witness growing investor interest in the sector and the expansion of Green Mortgages and Green Construction Loans offered by commercial banks and housing finance companies (HFCs) to developers. These developments are expected to provide a significant liquidity boost, fuelling the development of Green Housing across the country.

Shift to Green Affordable Housing

Sustainable and reduced consumption of water and energy

Improving Living Standards Enhanced thermal comfort, health, hygiene and better sanitation for its occupants

Energy Savings through improved ventilation and light in the dwelling units

Reducing GHG Emissions

Green Housing Rating

Green certifications offer a structured framework for project teams to design, construct, and operate housing buildings in an environmentally sustainable manner. These certifications focus on achieving specific benchmarks by implementing cost-effective, sustainable and eco-friendly strategies and technologies. By adopting green measures, buildings can make significant contributions to environmental conservation, and facilitate the development of climate-resilient and affordable structures.

As of March 31, 2023, our Green Value Partners hand held 30 affordable housing projects towards green certification under the Indian Green Building Council (IGBC)’s and GRIHA’s Green Housing Rating.