50 Lakh Home Loan EMI: Interest Rates, Tenure, and Eligibility Criteria

A home loan is a significant financial commitment and understanding the associated costs is crucial. One of the most important factors to consider is the equated monthly instalment (EMI). In this article, you will learn everything you need to know about a 50 lakh home loan EMI, including home loan interest rates, tenure, and eligibility criteria.

What is an EMI?

An EMI is the fixed monthly payment you make to repay your home loan over a chosen tenure. Each EMI consists of two components — the principal amount (the loan amount itself) and the interest accrued on the loan. In the initial stages, a larger portion of the EMI goes toward the interest, and as the loan progresses, more goes toward repaying the principal. This repayment structure is designed to ease the borrower with manageable monthly payments over time.

Several factors influence your EMI:

- Interest Rate: The higher the interest rate, the higher your EMI.

- Loan Amount: A larger loan amount will result in higher EMIs.

- Loan Tenure: A longer loan tenure can lead to lower EMIs but higher overall interest costs.

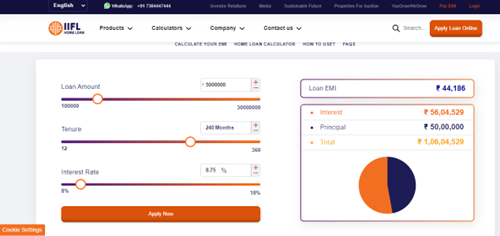

Calculating your EMI online

With the advent of online tools, calculating your EMI has never been easier. Home loan EMI calculators provided by banks and financial institutions allow you to input your loan amount, interest rate, and tenure to instantly see what your monthly installment will be. The 50 lakh home loan EMI calculators help you visualize how different variables like tenure and interest rates affect your EMI so that you can make an informed decision before taking a loan.

Interest Rates for a ₹50 Lakh Home Loan

Interest rates for home loans fluctuate based on various economic factors. Currently, home loan interest rates in India hover between 8.5-9% for most borrowers, depending on their credit score and the lenders. Keeping an eye on these benchmarks allows borrowers to negotiate better rates or choose the right time to lock in a rate.

Interest rates are often affected due to the following reasons:

- Economic Conditions: The overall economic health and interest rate trends can impact home loan rates.

- Lender Policies: Different lenders have varied pricing strategies and may offer varying home loan interest rates.

- Your Profile: Your credit score, income, and other financial factors can influence the home loan interest rate you're offered.

Depending on your risk-taking capacity, you can choose either a fixed or floating interest rate. Fixed rates remain constant throughout the loan tenure while floating rates can fluctuate based on market benchmarks.

Read more: Fixed and Floating Rate Home Loans: Which Option is Right for You?

Which loan tenure is ideal for you?

The tenure of your home loan of 50 lakh EMI can significantly impact your monthly payments. Longer tenures, such as 20 years, offer lower EMIs, making them affordable every month. However, longer tenures mean higher total interest costs. In contrast, shorter tenures increase your monthly EMI but reduce the total interest paid over the loan’s lifespan, enabling faster debt clearance.

When deciding on loan tenure, it's essential to consider your financial goals and capacity. A 50 lakh home loan EMI for 20 years might be more manageable month-to-month, but if you aim to reduce your total interest paid, a shorter tenure could be beneficial.

You can easily compare EMIs for different loan tenures using a 50 lakh loan EMI calculator. By adjusting the tenure slider, you’ll see how your monthly payments change. The home loan EMI calculator is a great tool for determining the most comfortable EMI for your financial situation without overextending your budget.

Eligibility criteria for a ₹50 lakh Home Loan

To qualify for a 50 lakh home loan, borrowers must meet certain eligibility criteria. Lenders evaluate various factors before approving a loan, ensuring the borrower can manage the 50 lakh loan EMI.

- Income Requirements: Lenders require borrowers to demonstrate a stable income capable of supporting the home loan of 50 lakh EMI. Lenders typically look for a debt-to-income ratio that indicates you can manage the loan repayment without strain. Salaried individuals may need to show consistent earnings over several years, while self-employed applicants may need to provide tax returns and financial statements to prove income stability.

- Credit Score: A healthy credit score is crucial when applying for a home loan. Most lenders prefer a credit score of 750 or above, as it demonstrates a history of responsible credit usage and repayment. A higher credit score not only improves your chances of loan approval but also qualifies you for better home loan interest rates. If your credit score is below the desired level, consider improving it before applying for a loan by clearing outstanding debts and maintaining timely payments.

- Documentation: To process your home loan, lenders will require a variety of documents. These typically include identity proof (like an Aadhaar card or passport), income proof (salary slips or tax returns), bank statements, property documents, and employment details. Ensuring that you have all these papers ready can speed up the loan approval process.

- Other Factors: Apart from income and credit score, lenders also evaluate factors like your employment stability and the value and location of the property. Stable employment in a reputable company or steady business income can enhance your eligibility. The property's location and market value also play a role, as lenders assess the resale potential and security of their investment.

Wrapping Up

Obtaining a 50 lakh home loan requires careful planning and consideration of various factors. By understanding interest rates, loan tenure, and eligibility criteria, you can make an informed decision and secure a loan that aligns with your financial goals. For more information and expert guidance on home loans, explore IIFL Home Loans.

FAQs

Q1. Can I prepay my home loan before the end of the tenure?

You can prepay your home loan before the end of its tenure, but some lenders might impose prepayment penalties.

Q2. Can I apply for a joint home loan of 50 Lakh?

Yes, applying for a joint home loan can enhance your eligibility, as combined incomes allow for higher loan amounts and potentially lower EMIs.

Q3. Is it better to choose a fixed or floating rate for a home loan?

Fixed rates offer stability while floating rates provide potential savings when market rates drop. The choice depends on your financial goals.

Q4. What happens if my credit score is low?

A low credit score may lead to higher interest rates or even loan rejection. Improving your credit score before applying is advisable.

Q5. What is the maximum tenure for a ₹50 lakh home loan?

Most lenders offer home loan tenures of up to 30 years, depending on your eligibility such as age, income, credit score, employment stability, and existing financial obligations. Lenders assess these factors to determine your ability to repay the loan.

Tags

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login