Affordable Housing To Get a Boost As Home Loans To Cost Less

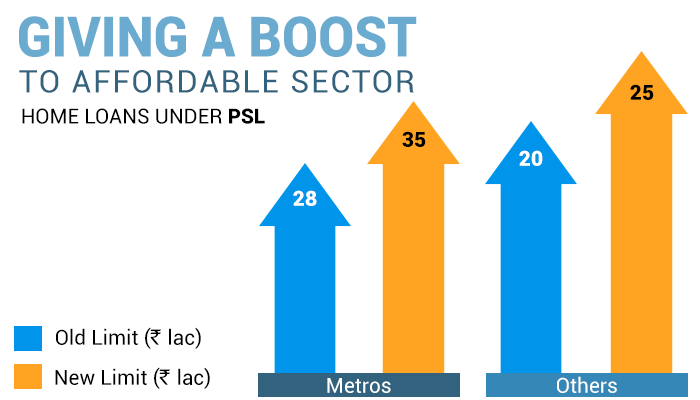

On 6 June 2018, Reserve bank of India revised home loan limits for priority sector lending in India. This implies that home loan limit for home buyers belonging to economically weaker sections will increase to Rs. 35 lacs from Rs. 28 lacs in metros and from Rs. 20 lacs to Rs. 25 lacs in non-metro cities.

As per RBI guidelines, bank in India have to lend 40% of all home loans to priority sector lending such as borrowers belonging to economically weaker sections and agricultural sectors etc. RBI decision to increase the limit will prompt lenders to focus more on the small-ticket size segment in order to increase their market share.

As per the revised policy of RBI, the home loan limit in non-metro centers will be increased from Rs. 20 lacs to Rs. 25 lacs. However, it should be noted that cost of the dwelling should not exceed Rs. 45 lacs in metro centres and Rs. 30 lacs in non-metro centres.

The decision to increase the limit will give boost to first-time home buyers in the country especially in the affordable housing segment. The move by RBI aligns perfectly with Pradhan Mantri Awas Yojana PMAY in which customers belongs to EWS/LIG category can avail CLSS Credit Linked Subsidy of up to Rs. 2.67 lacs*

Tags

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login