Understanding Home Loan Amortization: Step-by-step explanation

Ever feel like your home loan repayments are all going towards interest, with little chipping away at the actual loan amount? Amortization, a core concept in home loan repayment, sheds light on this. Understanding amortization empowers you to make informed financial decisions, plan your budget effectively, and approach your home loan repayment strategy with clarity.

Understanding EMI and Home Loan Tenure

Amortization refers to the gradual repayment of a loan, wherein each monthly payment is divided between principal (the actual borrowed amount) and interest (the cost of borrowing). Over the loan term, the proportion of principal steadily increases as the interest component progressively decreases. This creates a predictable payment amortization schedule home loan, allowing you to visualize how your home loan progresses towards full repayment.

Don't confuse amortization with simple interest. Simple interest calculates interest solely on the initial loan amount, making payments predictable but potentially less accurate. Amortization, on the other hand, factors in the reduction of loan balance, resulting in a more realistic picture of how your payments contribute to both principal and interest. Here are a few key terms to look at:

- Principal: The original loan amount you borrow from the lender.

- Interest: The cost you pay for borrowing the principal amount, typically expressed as a yearly percentage (APR).

- Term:The total duration of your home loan, usually spanning 15 to 30 years.

- EMI (Equated Monthly Installment):The fixed monthly payment you make towards your home loan, encompassing both principal and interest.

How Amortization works?

Each EMI you make is strategically divided into two parts:

- Principal Component:This portion directly reduces your outstanding loan balance. As you make consistent payments, the principal component increases with each instalment.

- Interest Component:This represents the interest accrued on the remaining loan balance. Initially, the interest component forms a larger portion of the EMI, gradually decreasing as the principal component grows.

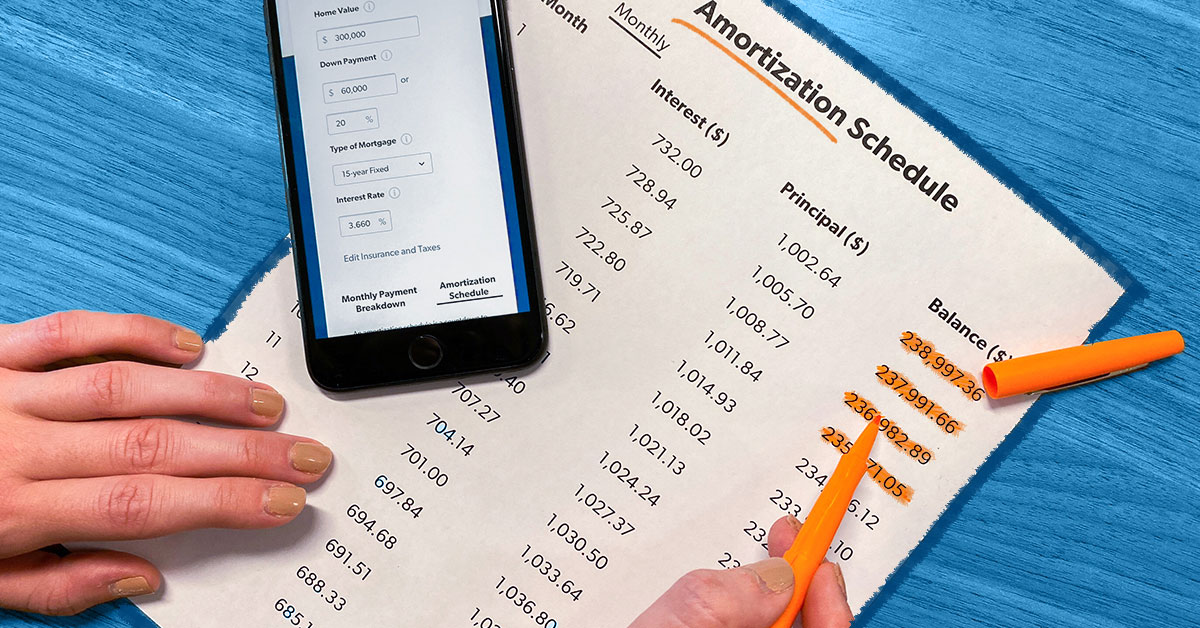

Most lenders provide a mortgage amortization schedule outlining the breakdown of each EMI into principal and interest for the entire loan term. This offers valuable insights:

- Early PaymentsHigher Interest, Lower Principal: In the initial stages of your loan, a larger chunk of the EMI goes towards interest due to the high outstanding balance.

- Later Payments:Over time, the principal component rises as the loan balance shrinks, reducing the interest amount and increasing the portion that goes towards paying off the principal.

Types of Amortization methods

There are two types of amortization methods, let's look at them.

Fixed-Rate Amortization

- Consistent Monthly Payments:Fixed-rate amortization offers the security of predictable EMIs throughout the loan term. The home loan interest rate remains constant, ensuring consistent monthly payments regardless of fluctuations in market rates.

- Impact on Long-Term Financial Planning:Knowing the exact monthly payment amount simplifies budgeting and long-term financial planning. You can confidently factor your home loan repayment into your overall financial picture.

Adjustable-Rate Amortization (ARM)

- Variable Interest Rates:ARMs come with interest rates that can adjust periodically (often annually or every few years) based on market conditions. This can lead to fluctuations in your EMI amount.

- Benefits and Risks:ARMs may initially offer lower interest rates compared to fixed-rate loans. However, rising interest rates can significantly increase your EMIs in the future, potentially impacting your budget.

Calculating Amortization

While there are online calculators to simplify the process, understanding the basic amortization formula can be empowering:

EMI = (P R (1 + R) ^ T) / ((1 + R) ^ T - 1)

Where:

- EMI = Equated Monthly Installment

- P = Principal amount

- • R = Monthly interest rate (annual interest rate divided by 12)

- • T = Loan term in months

Several online amortization calculators are readily available. These tools require you to input your loan amount, interest rate, and loan term, and they will calculate your EMI and generate a detailed amortization schedule.

Benefits of understanding Amortization

There are various benefits of amortization, let's look at them.

Financial Planning and Budgeting

Understanding amortization equips you to make informed financial decisions. You can accurately factor your monthly EMI into your budget and plan for future expenses with greater confidence. It also helps you anticipate how much of your payment goes towards principal reduction, offering a clearer picture of your progress towards loan ownership.

Impact on Loan Repayment Strategies

- Prepayment:Amortization schedules can help you determine the impact of prepayments. By making additional lump sum payments towards the principal, you can significantly reduce your loan term and save on overall interest costs.

- Refinancing Options: When considering refinancing your home loan, understanding amortization allows you to compare the new loan's amortization schedule with your existing one. This facilitates informed decision-making by highlighting potential savings or increased costs associated with refinancing.

Enhanced Financial Literacy

Grasping amortization empowers you to become a more financially literate borrower. You can confidently engage in discussions with lenders, understand loan terms better, and make strategic financial choices regarding your home loan.

Common misconceptions about Amortization

A common misconception is that your entire EMI goes towards interest in the initial years. While the interest component is higher initially, it steadily decreases as the principal component rises.

Don't expect a significant principal reduction in the beginning. However, amortization ensures consistent progress. Over time, the principal portion steadily grows, ultimately leading to full loan repayment.

Only fixed-rate amortization offers consistent monthly payments. Adjustable-rate mortgages (ARMs) have fluctuating interest rates that can impact your EMI amount.

Wrapping Up

Amortization is the cornerstone of home loan repayment, dictating how your monthly payments are allocated between principal and interest. Understanding amortization empowers you to manage your finances effectively, make informed decisions about prepayment or refinancing, and ultimately achieve your dream of homeownership with greater financial clarity.

The financial landscape is dynamic. Equipping yourself with ongoing financial knowledge empowers you to make well-informed decisions throughout your home loan journey.

Utilise online amortization calculators and consult with financial advisors such as IIFL Home Loans to gain a deeper understanding of your specific home loan and explore potential financial strategies.

FAQs

Q1. What is the difference between principal and interest in an amortised loan?

Principal is the initial loan amount you borrow, while interest is the cost you pay for borrowing that money. Amortization ensures your monthly payments contribute to both principal and interest over the loan term.

Q2. How can I create my own amortization schedule home loan?

Online amortization calculators are readily available. Alternatively, you can use spreadsheet software and apply the amortization formula to generate a home amortization schedule.

Q3. Is it beneficial to make extra payments on an amortised loan?

Absolutely! Making extra payments directly reduces your outstanding loan balance, saving you money on interest in the long run and potentially shortening your loan term.

Q4. How does the amortization process differ for adjustable-rate mortgages?

With ARMs, the interest rate adjusts periodically, impacting your monthly payment amount. The amortization schedule will reflect these changes, with the principal component potentially fluctuating depending on the adjusted interest rate.

Q5. What happens if I refinance my loan in terms of amortization?

Refinancing your loan creates a new loan with a potentially different interest rate and term. A new amortization schedule will be generated based on the refinanced loan details, allowing you to compare the impact on your overall repayment plan.

Tags

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login